PaYsnapper — Your trusted Guide to the world of payments

in Africa and the Middle East.

We empower high-growth businesses

to deliver their services across the world.

The world is truly beautiful in its diversity, and this applies not only to cultural differences but also to the business landscape.

With years of experience in payment processing across emerging markets and state-of-the-art payment software,

Paysnapper is the perfect partner for global merchants.

platform

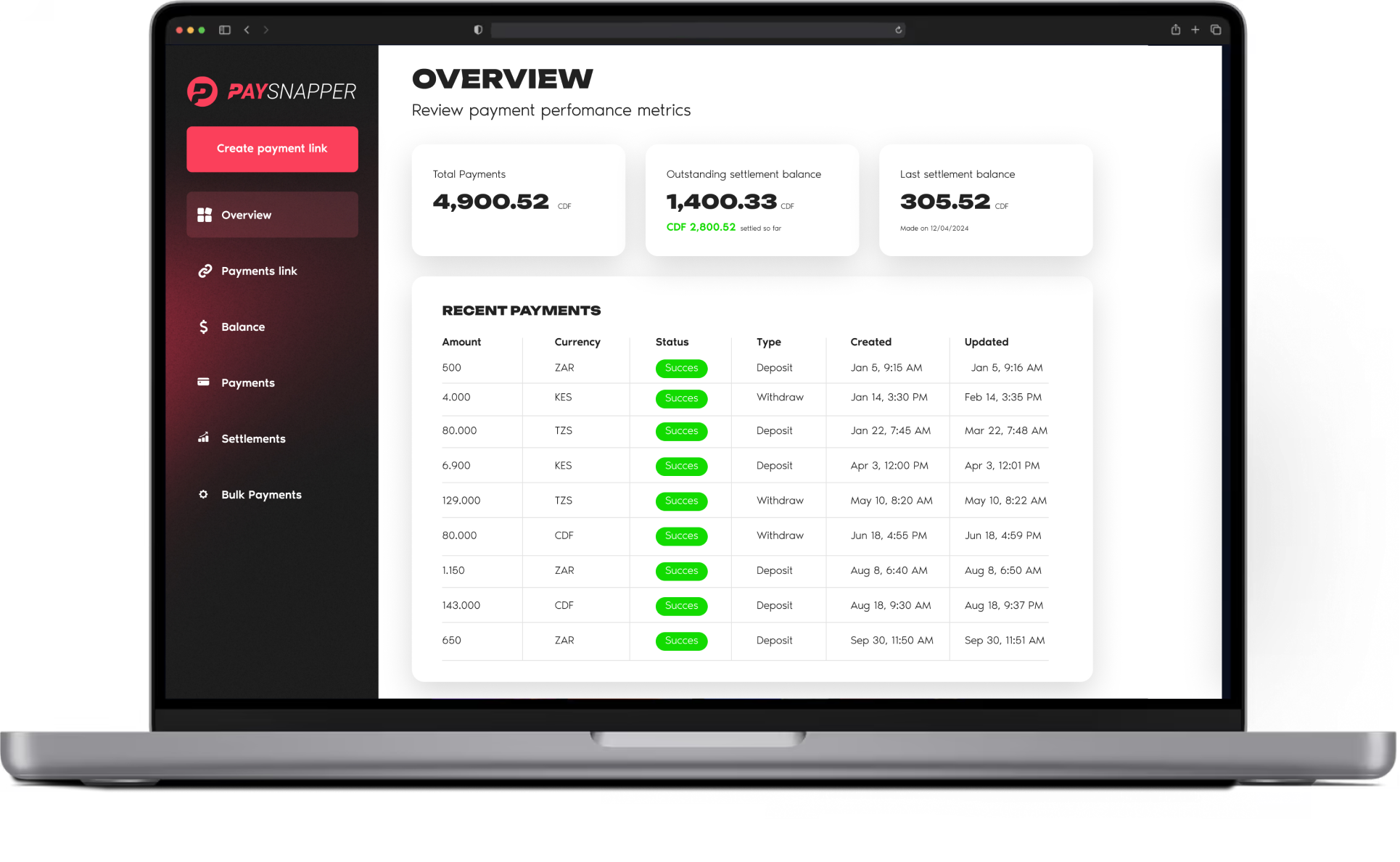

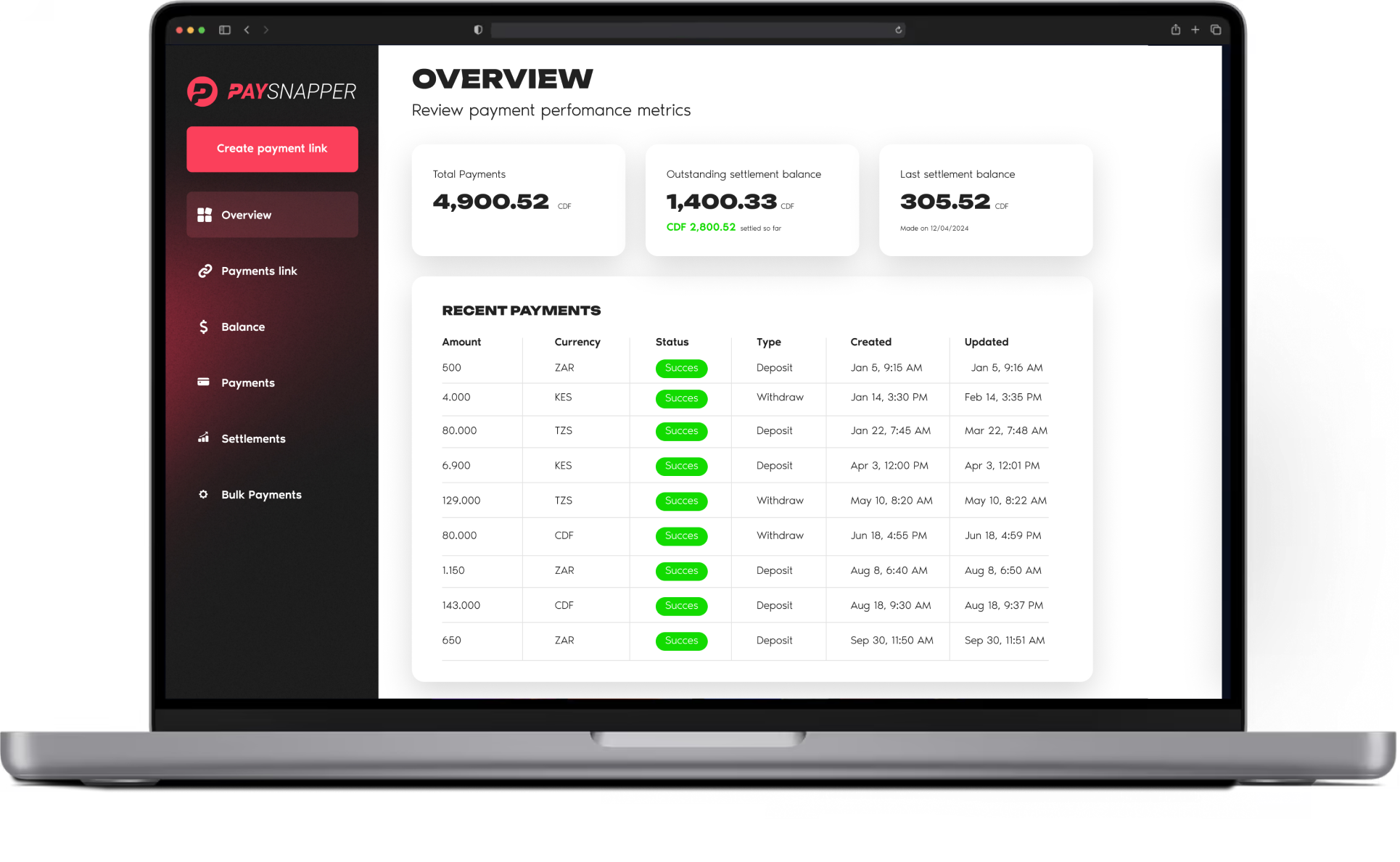

Paysnapper clients engage with a smart next-generation payment platform, built with computational capacity designed to scale for years to come.

Monitor your deps and payouts in real-time, manage provider fees across different countries, and leverage powerful analytics for better insights.

payments

Not a single transaction will slip through your fingers.

All payments are displayed on payment registers with real-time status updates. Enjoy the advantage of collecting payments in multiple currencies.

Financial and transaction reconciliations are no longer a headache. With a high level of automation, your CFO won’t need to spend hours on spreadsheets — all is already calculated by the platform.

The Paysnapper platform is designed with our clients’

needs in mind and comes with specialized features.

orchestrates payment flows, distributing them among partnering PSPs based on priority. If a certain channel becomes unavailable, the platform automatically redirects the necessary volume of traffic to the next prioritized PSP.

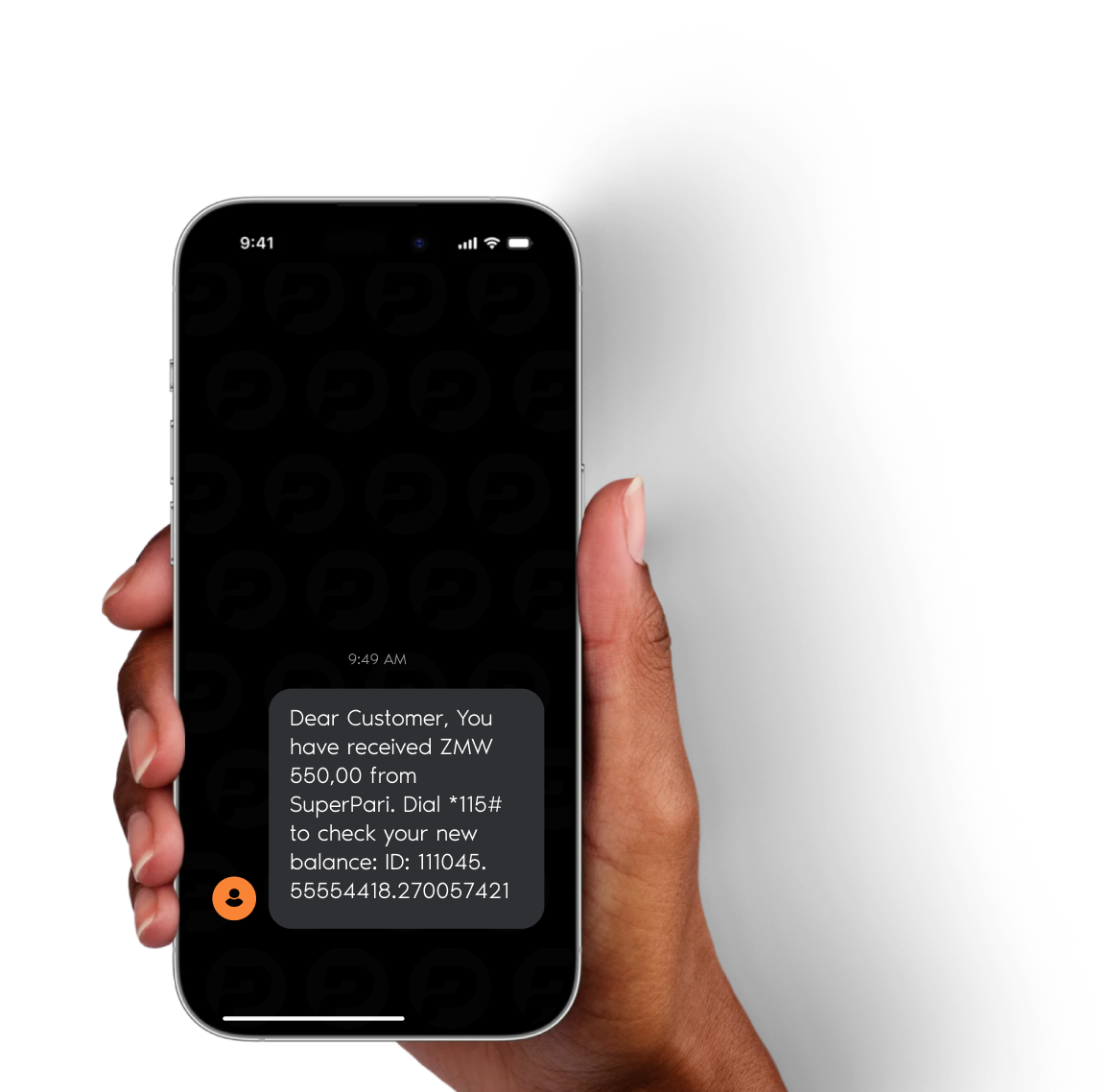

APM is crucial for emerging markets,

providing millions of people with access to financial services where traditional banking infrastructure is lacking.

Paysnapper’s core gateway is fully integrated with the most popular mobile money providers across Africa, ensuring businesses can reach their customers. Our platform supports leading telcos on the territories such as Kenya, Tanzania , Uganda, Ghana, Rwanda, Zambia, Ivory Coast, Senegal, Mali, Cameroon, Benin, Ivory Coast. This extensive network ensures seamless transactions across key African markets.

We work tirelessly to ensure that global merchants can operate seamlessly in an open world.

This has never been easier thanks to the robust infrastructure built by the Paysnapper team. Multichanneling is one of our core values. We partner only with trusted local providers, while ensuring multiple backup integrations are in place. Even in the face of unforeseen challenges, our clients’ businesses never stop — show must go on !

Paysnapper is constantly working

on robust payment infrastructure to enable timely cross-border money transfers, utilizing the trending services and technologies.